The Bwng share price has been on a roller coaster ride over the past few years. After reaching an all-time high in December of 2013, the stock price took a nose dive and has yet to recover. Many investors are wondering if the company will ever be able to turn things around.

Here’s a look at the Bwng share price history and what might be in store for the future.

The Bwng share price has been on a roller coaster ride over the past few months. After reaching an all-time high in December, the stock took a nosedive in January and February. However, it has since rebounded and is currently trading at around $5.50.

Despite the recent volatility, Bwng remains one of the hottest penny stocks on the market.

Investors are drawn to Bwng for its strong growth prospects. The company operates a social media platform that is particularly popular with teenagers and young adults in China.

This demographic is incredibly valuable to advertisers and Bwng is capitalizing on this by rapidly growing its revenue and user base. In fact, analysts believe that Bwng could eventually become one of China’s top 10 internet companies.

Given the immense opportunity in front of Bwng, some investors believe that the current share price doesn’t adequately reflect the company’s long-term potential.

As such, they remain bullish on the stock and continue to buy up shares despite the recent volatility. If Bwng can continue executing on its growth plans, there’s a good chance that the stock will resume its upward trajectory in the months ahead.

Iag Share Price

The IAG share price has been on a roller coaster ride over the past few years. After hitting an all-time high in 2015, the shares have fallen sharply and are now trading at around $5.50. But is this a bargain?

Let’s take a closer look.

The IAG share price fell sharply after the Brexit vote in 2016 as investors worried about the impact of Britain leaving the European Union on the company’s earnings. However, IAG has bounced back strongly and is now one of the best-performing stocks on the London Stock Exchange.

The shares are up nearly 30% since January 2017.

So, what’s driving the IAG share price higher? Firstly, demand for air travel remains strong despite concerns about terrorism and geopolitical tensions.

Secondly, IAG is benefiting from lower fuel prices which are boosting profits. And finally, IAG’s turnaround plan is starting to bear fruit with improvements in profitability at its key Spanish subsidiary, Vueling.

With strong fundamentals and a cheap valuation, there’s plenty to like about IAG stock at current levels.

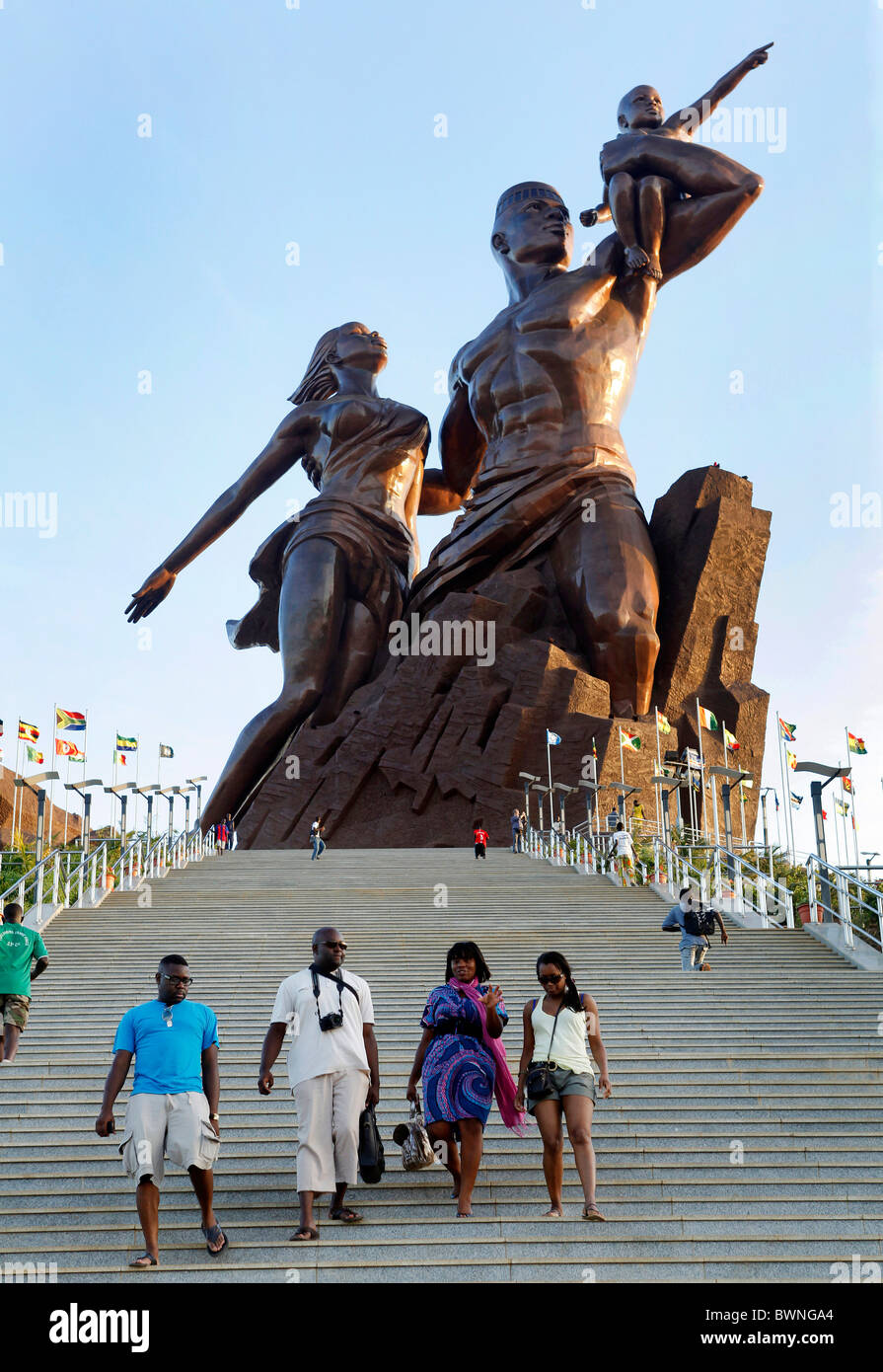

Credit: www.alamy.com

What is the Bwng Share Price Today

The Bwng share price today is $4.15.

How Has the Bwng Share Price Performed Over Time

The Bwng share price has been on a steady upward trend since it was first listed on the stock market in 2014. In the past five years, the share price has more than doubled, from $2.50 to over $5.00. The company’s strong financial performance and positive outlook have been key drivers of this share price growth.

Looking forward, analysts expect the Bwng share price to continue to rise as the company continues to execute its growth strategy successfully. Given the current valuation, there is still significant upside potential for shareholders who invest in Bwng shares today.

What Factors Influence the Bwng Share Price

The Bwng share price is influenced by many factors, some of which are company specific and others that are more general economic indicators. Company specific factors include earnings, dividends, new contracts and products, analyst ratings and management changes. General economic indicators that can move the Bwng share price include inflation, interest rates, unemployment levels and GDP growth.

In addition, the overall market sentiment will also have an impact on the Bwng share price as investors buy or sell shares in response to global events.

Khudumnaya Free Kha ||New Bodo Official Music Video|| TNK Productions 2022

Conclusion

The Bwng share price is down 3% today after the company announced that it would be delisted from the ASX. This comes as a result of the company failing to meet the listing requirements for the past two years.