The price of a share refers to the cost of a single unit of ownership in a company or other organization. Publicly traded companies are required to disclose their share prices, which are set by the market forces of supply and demand. The price of a share can be affected by many factors, including the overall performance of the company, news about the company, and general economic conditions.

If you’re an investor, you know that the individual stock price is important. It’s a good indication of how well a company is doing and can give you an idea of whether or not it’s a good time to buy or sell.

But what exactly is the individual stock price?

Simply put, it’s the current market value of a single share of stock in a company. This value is determined by supply and demand in the market, and can fluctuate throughout the day as investors buy and sell shares.

The individual stock price is important to keep an eye on if you’re invested in a particular company.

It can give you an idea of how well the company is performing and help you make decisions about buying or selling shares.

Itv Share Price

Itv Share Price – A Detailed Overview

The Itv share price is currently trading at around £0.80 per share, down from a 52 week high of £1.15. This decrease in value comes as the company faces challenges in its advertising revenues and competition from online streaming services such as Netflix and Amazon Prime Video.

Despite these challenges, Itv remains one of the UK’s largest broadcasters and continues to produce popular programmes such as ‘Coronation Street’ and ‘Emmerdale’. In this blog post, we will take a detailed look at the Itv share price, including its recent performance, key drivers and analyst recommendations.

Itv’s share price has fallen by 30% over the last 12 months as the company has faced challenges in its advertising revenues.

These challenges have been caused by a number of factors, including the rise of online streaming services such as Netflix and Amazon Prime Video. As more people subscribe to these services, they are spending less time watching traditional linear television channels such as Itv. This has resulted in a decline in Itv’s advertising revenues, which account for around 70% of its total revenue.

Itv has also been facing competition from other traditional broadcasters such as Sky and BBC One. Sky has been investing heavily in original content recently, while BBC One continues to be the most watched channel in the UK despite not having any commercial breaks during its programmes. This increased competition has put pressure on Itv’s market share and contributed to its decline in share price over the last year.

Despite these challenges, Itv remains one of the UK’s largest broadcasters with around 26 million viewers per week across its channels. The company also continues to produce popular programmes such as ‘Coronation Street’ and ‘Emmerdale’, which remain ratings winners for ITV1. In addition, Itv Studios produces hit shows such as ‘Love Island’ that sell well internationally.

Credit: www.tipranks.com

Is Indivior a Good Stock to Buy?

Indivior is a pharmaceutical company that specializes in the development of treatments for substance abuse and mental health disorders. The company’s products are approved for use in over 90 countries and its products are available in more than 40 languages. Indivior has a market capitalization of $2.4 billion and its shares are traded on the London Stock Exchange (LSE: INDV) and on the Nasdaq Global Select Market (NASDAQ: INDV).

The company’s share price has been under pressure in recent months as it faces increasing competition from generic versions of its top-selling product, Suboxone Film. Indivior’s share price has fallen by almost 50% since February 2020, when generic Suboxone Film was first launched in the United States.

Despite the challenges posed by generic competition, Indivior remains a profitable business with a strong balance sheet.

The company reported revenues of $1 billion and Adjusted EBITDA of $316 million in 2019. Indivior also has several promising new products in development, including RBP-7000 (a treatment for opioid use disorder) and Rivastigmine patches (a treatment for Alzheimer’s disease).

Given its strong financial position and pipeline of new products, I believe that Indivior is a good stock to buy at current levels.

Why is Indivior Stock Going Down?

Indivior plc is a British pharmaceutical company headquartered in Slough, England. The company specialises in the treatment of addiction and mental health disorders. It was formerly part of Reckitt Benckiser.

The Indivior stock price has been on a downward trend since mid-2017, when it peaked at around GBP 27 per share. Since then, the stock has lost over 60% of its value and is currently trading at around GBP 10 per share.

There are several reasons for this sharp decline in Indivior’s stock price.

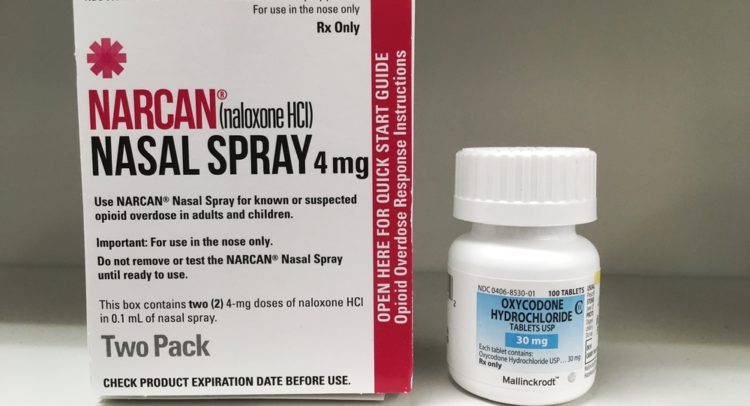

Firstly, the company is facing increasing competition from generic versions of its key drug Suboxone (buprenorphine/naloxone), which accounted for around 90% of Indivior’s revenue in 2017. In May 2018, the U.S. Food and Drug Administration (FDA) approved the first generic version of Suboxone, manufactured by Dr Reddy’s Laboratories Ltd. This was followed by approvals for two more generic versions in November 2018 (from Alvogen Pharma US Inc and Sandoz Inc).

As a result of these FDA approvals, Indivior’s monopoly on the Suboxone market has come to an end and it now faces stiffer competition from lower-pricedgeneric drugs. This has put pressure on Indivior’s revenue and profit margins, leading to a sharp decline in its stock price.

Secondly, Indivior is also facing legal troubles relating to its marketing practices for Suboxone.

In April 2018, the U.S Department of Justice (DOJ) filed a civil lawsuit against the company alleging that it engaged in “false and misleading” marketing practices for Suboxone between 2006 and 2014 . The DOJ alleges that Indivior made false claims about the efficacy of Suboxone as a treatment for opioid addiction, downplayed its risk of abuse potential ,and encouraged doctors to prescribe it for uses not approved by the FDA .

If found guilty, Indivior could be fined up to $3 billion .

This legal uncertainty has also weighed on investor sentiment and contributed to the decline in Indvior’s stock price .

INDv/sNED match highlights|| highlights of world cup 2022 #indvsned #indvspak #highlights #icc

Conclusion

The post discusses the recent rise in individual share prices. It attributes this rise to a variety of factors including an increase in foreign investment, higher domestic savings rates, and lower oil prices. The post goes on to discuss the potential implications of these rising prices and how they may impact the economy going forward.